- His Excellency Dr Thani bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade: “Through the Ministry of Economy and its UAE Gold Bullion Committee, we are further positioning the UAE at the heart of the global gold trade”

- Global sourcing integrity is critical to the future of the industry: UAE Good Delivery Standard and Due Diligence Regulations for Responsible Sourcing of Gold to play a key role

- Emerging technologies such as tokenisation can make gold trading more transparent and accessible

- Hundreds of traders, regulators, industry bodies and exchanges attended the tenth edition of DPMC

DMCC successfully concluded the tenth edition of the Dubai Precious Metals Conference (DPMC), in partnership with the United Arab Emirates Ministry of Economy, today at Atlantis, The Palm, Dubai.

This year’s edition focused on four key themes – the future of precious metals trade, stepping up sourcing integrity, financialisation of the precious metals trade and resetting global price benchmarks.

Hundreds of traders, regulators, industry bodies and exchanges gathered to discuss these themes, with a particular emphasis on the need to continuously enhance sourcing integrity in the precious metals industry. The Ministry of Economy’s UAE Good Delivery Standard and recently updated Due Diligence Regulations for Responsible Sourcing of Gold are critical to the future of gold trading in the UAE and the industry as a whole, with all gold refineries and other regulated entities operating in the country required to meet international standards and best practices.

Speakers and delegates also focused on the potential for tokenisation to not only make the trading of gold more transparent and traceable but also more accessible. On the eve of DPMC, DMCC announced a partnership with Comtech Gold to digitise the trading of gold by tokenising the precious metal and linking each token to DMCC Tradeflow warrants, with traders able to buy as little as one gram of gold.

The opening keynote address was delivered by His Excellency Dr Thani bin Ahmed Al Zeyoudi, UAE Minister of State for Foreign Trade, who said: “The UAE has become a thriving hub for the precious metals trade, meaning there is no better place to host such a prominent conference. Through the Ministry of Economy and its UAE Gold Bullion Committee, we are further positioning the UAE at the heart of the global gold trade, upholding the highest international standards in key areas such as financing and the responsible resourcing of gold. I would like to thank DMCC for the significant role that they have played in building the UAE’s gold industry.”

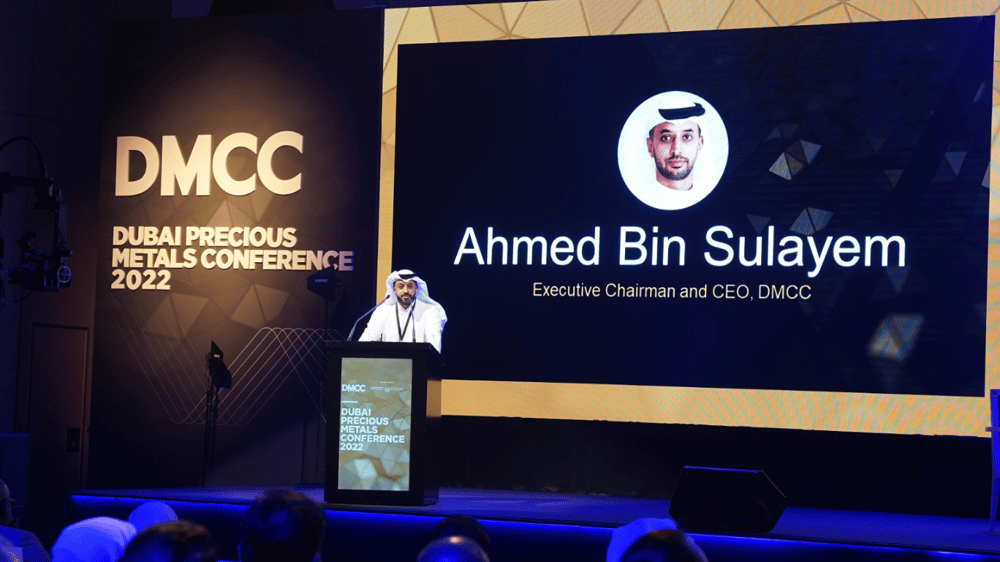

Delegates were welcomed by Ahmed Bin Sulayem, Executive Chairman and Chief Executive Officer of DMCC, and Chairman of the Dubai Gold & Commodities Exchange (DGCX), who said: “The UAE has a critical role in helping shape the future of the precious metals industry and ensuring that the trade of gold and precious metals is fair, transparent and traceable. This year’s Dubai Precious Metals Conference underlined the need for market participants around the world to embrace emerging technologies such as tokenisation and blockchain, which have the potential to transform the way precious metals are traded and drive the long-term sustainable growth of the industry. DMCC is honoured to host leaders from across every part of the global precious metals industry in Dubai and we are looking forward to working even closer together in the months and years ahead to move forward and capitalise on emerging opportunities.”

In a keynote address, where he discussed the end of dollar hegemony, the demise of Bitcoin, the future of blockchain and crypto and the global remonetisation of gold, Peter Schiff, Chief Economist and Global Strategist, Euro Pacific Capital, said: “There is a common misconception that bitcoin is a replacement for gold. While it may be more easily traded, this is incorrect as bitcoin lacks the intrinsic value provided by physical gold. However, the same technologies used to trade bitcoin can be used to trade tokenised gold, meaning you retain the actual store of value that gold provides. In the same way that the world used to trade banknotes that acted as redeemable notes for gold, blockchain technologies can be used more efficiently to trade and register the ownership of gold. In my mind, this is the direction that the world’s monetary system needs to move towards to tame inflation in the long term – a blockchain-enabled gold standard.”

Meanwhile, David Tait, CEO, World Gold Council, said to DPMC delegates: “I am honoured to address the industry today as we tackle some of the sector’s most pressing issues. Through our blockchain-based Gold247 ecosystem, we are driving collaboration throughout the entire value chain to grow the global gold market by targeting integrity, accessibility and fungibility. We have a shared commitment to work in a responsible and sustainable way, and only the entire industry working under one banner can we achieve this. I am looking forward to working closely with the UAE’s Ministry of Economy and DMCC to strengthen the integrity of the global gold market.”

DPMC also saw the unveiling of the second edition of the UAE Gold Bullion Coins from DMCC. The four new 2022 coins, which will be minted and available for purchase in early 2023, are inspired by the UAE’s achievements over the past 50 years – a reflection of the nation’s rich past and promising future.

Over the course of the day, delegates discussed the influence of bilateral and multilateral trade agreements, the changing role of market infrastructure institutions, reforms through digitisation, the role of technology infrastructure in trade and physical investment market, the evolving nature of bullion trading centres and increased relevance of standardisation, and the shifting influence in global supply chains of major gold producers such as China and Russia.

Speakers and panellists delved into some of the recent global risks and challenges facing the sector, namely post-pandemic efforts to ramp up sourcing integrity measures, the effects of geopolitical events such as conflicts in mining regions, the challenges faced by auditors and compliance officers, mitigating risks in scrap reporting, managing sanctions and trade diplomacy.

The financialisation of the precious metals trade was in focus, with DPMC 2022 looking at the role of banks and other financial institutions, as well as vaulting infrastructure and digitisation of assets. Speakers explored Dubai’s trade flows and RFID jewellery financing, as well as the creation of a Gold Repo Market on the Dubai Gold & Commodities Exchange.

The final panel of the day tackled the resetting of global price benchmarks and whether new benchmarks need to be created. Speakers also discussed the ongoing relevance of gold-dollar correlation and gold-silver ratio in the new world order, and the modern investment case for gold.

In his final remarks, Ahmed Bin Sulayem, said: “As a facilitator and promoter of trade through Dubai, DMCC is committed to solidifying the Emirate’s status as a global hub for the trade of precious metals.”